The

BoardAdvisor™

.com

A Board-in-One™

bringing expertise, perspective and growth in value

to leading closely-held companies and their owners

Poster Collection

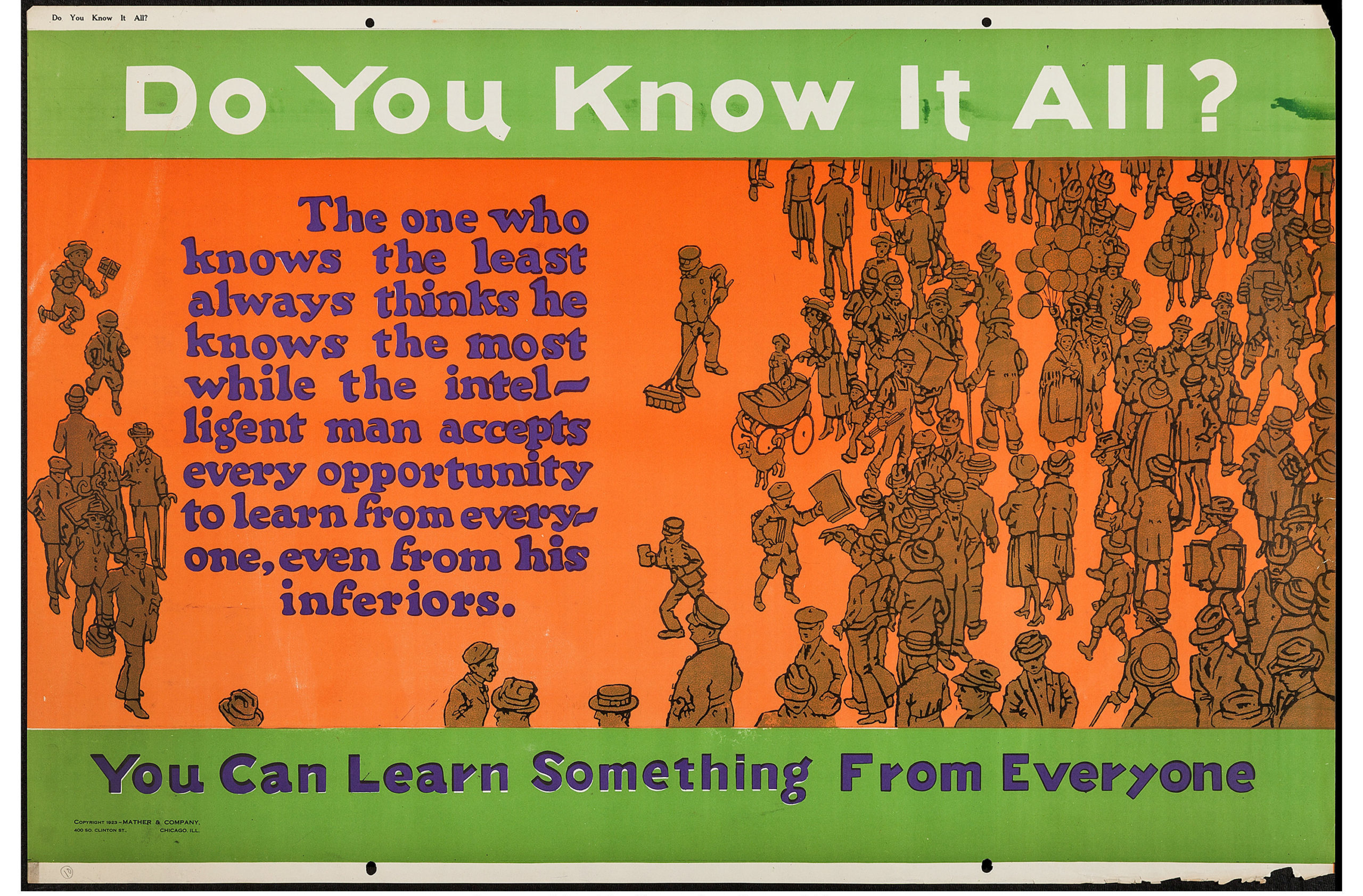

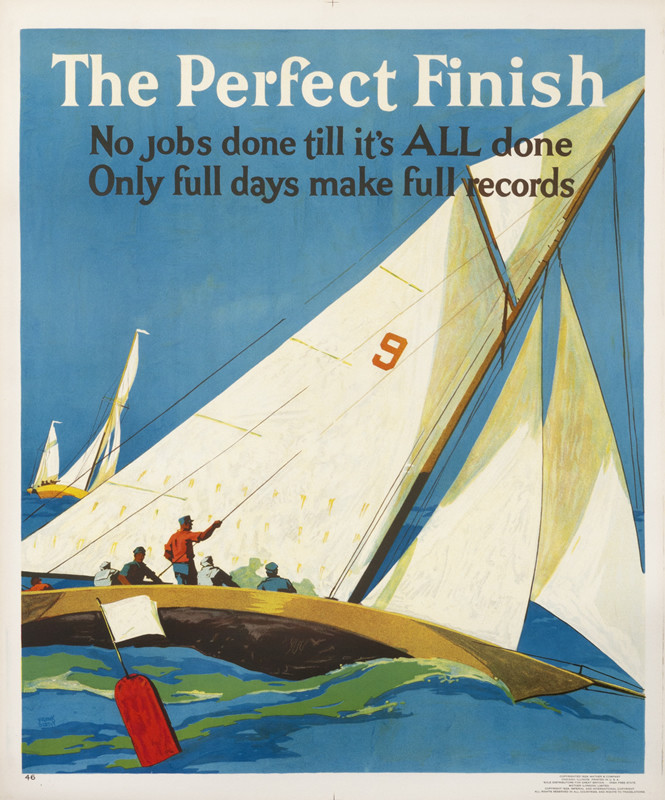

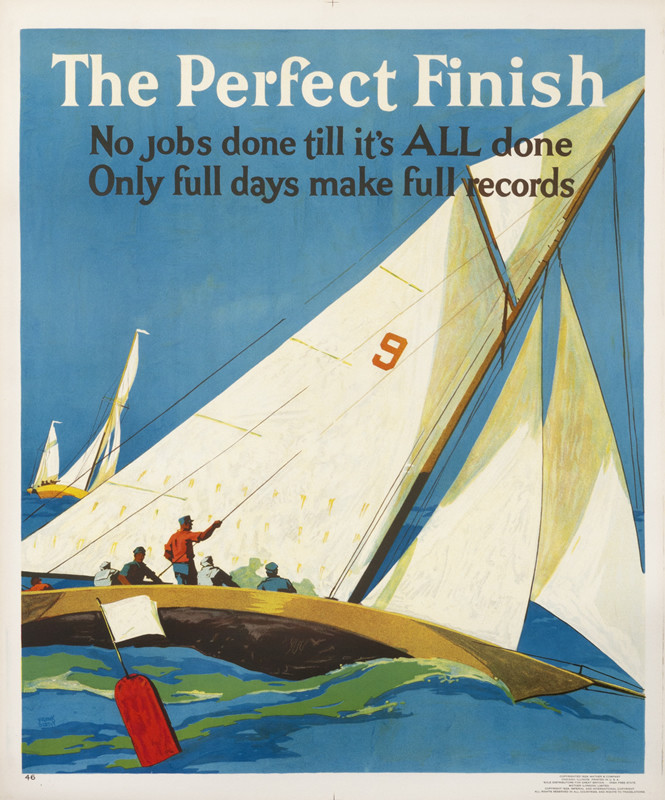

If you have been to our office, you are probably familiar with our collection of vintage “work incentive” posters of the 1920s.

If you have been to our office, you are probably familiar with our collection of vintage “work incentive” posters of the 1920s.

We admire the motivating and inspiring theme of these works of art. They encourage hard work, responsibility, attention to detail, and fair dealing — so do we.

Poster Collection

If you have been to our office, you are probably familiar with our collection of vintage “work incentive” posters of the 1920s.

We admire the motivating and inspiring theme of these works of art. They encourage hard work, responsibility, attention to detail, and fair dealing — so do we.

Boards supervise the activities of organizations; serving as fiduciaries for shareholders; guiding, approving and resourcing strategic plans; and engaging, compensating and supporting the C-Suite. Every company has a Board, and every public company’s board is well-developed.

Boards supervise the activities of organizations; serving as fiduciaries for shareholders; guiding, approving and resourcing strategic plans; and engaging, compensating and supporting the C-Suite. Every company has a Board, and every public company’s board is well-developed.

But, what about private, closely-held companies? They know they’ll benefit from the perspective, expertise and value-add of a functioning Board but they aren’t inclined to expand their Statutory Board (regulating owner decisions and compensation), and they’d rather not incur the costs of multiple Director fees, D&O insurance, Board counsel, etc.

So, form an Advisory Board, right? Unfortunately, most Advisory Boards aren’t effective. Too casual. Too uncompensated. Too little skin-in-the-game. Often, more window-dressing than value-added directorship.

Enter TheBoardAdvisor™. More effective than an Advisory Board. Much like an expanded Statutory Board with all the upside, little of the downside, and great flexibility. A Board-in-One™ with resources far beyond those of the typical closely-held company.

Established in 1993, David N. Deutsch & Company is the strategic financial advisor of leading closely-held companies, their owners and boards. We’re an investment bank, managing complex, structured, negotiated M&A transactions and equally a long-term strategic financial advisor to our clients – whether they transact or not – with experience and expertise in corporate finance and reporting, corporate development and M&A, strategy, risk, governance and executive oversight. TheBoardAdvisor™ helps closely-held companies and their owners make better decisions, mediate among owners and senior managers, and prepare for succession and winning exits.

If you get the good of good governance, call (212) 980-7800 and ask for David, the original BoardAdvisor™.